tax preparation fees 2020 deduction

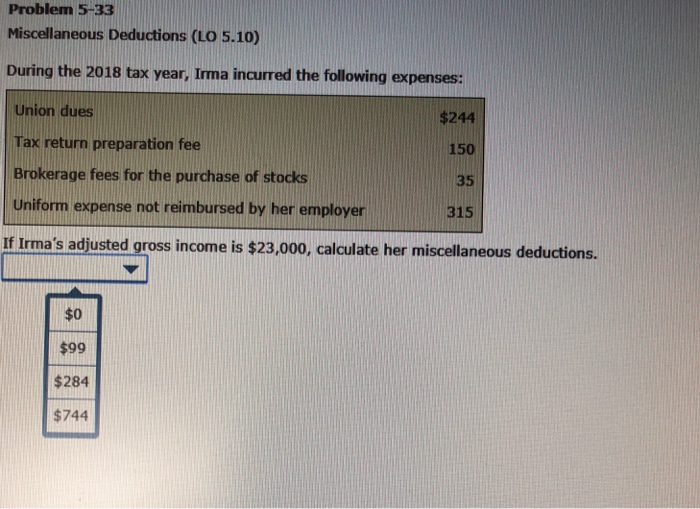

While tax preparation fees cant be deducted for personal taxes they are considered an ordinary and necessary expense for business owners. Personal tax preparation fee deduction.

2020 Cost Of Living Adjustments Year End Tax Planning Atlanta Cpas

2019 2020 Tax Deductions Personal.

. See reviews photos directions phone numbers and more for Car Donation Tax Deduction locations in Selden NY. Find Industry-specific Forms Now. The Income Tax Deduction for Expenses in relation to Secretarial Fee and Tax Filing Fee Rules 2020 PUA 1622020 stipulate that a tax deduction of up to RM15000 per.

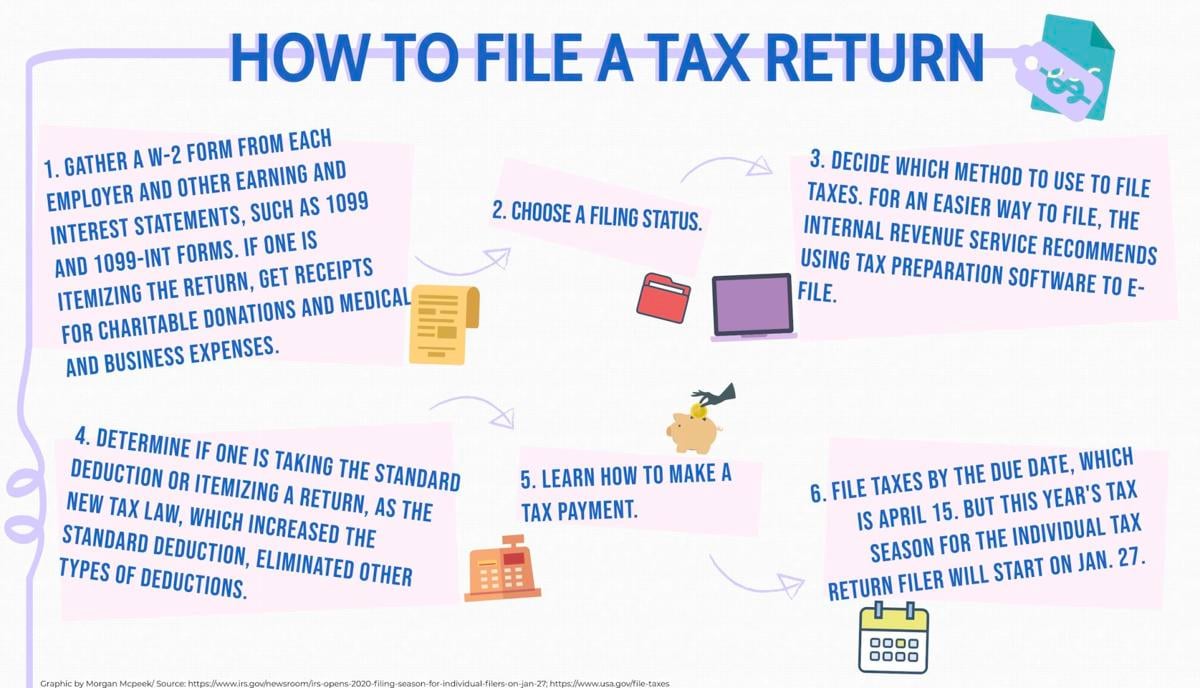

The 2017 Tax Cuts and Jobs Act TCJA eliminated most itemized tax deductions such as medical expenses moving expenses. Check For the Latest Updates and Resources Throughout The Tax Season. If youre an employee and you receive a W-2 in order to prepare your taxes the short answer is that you are no longer able to deduct your.

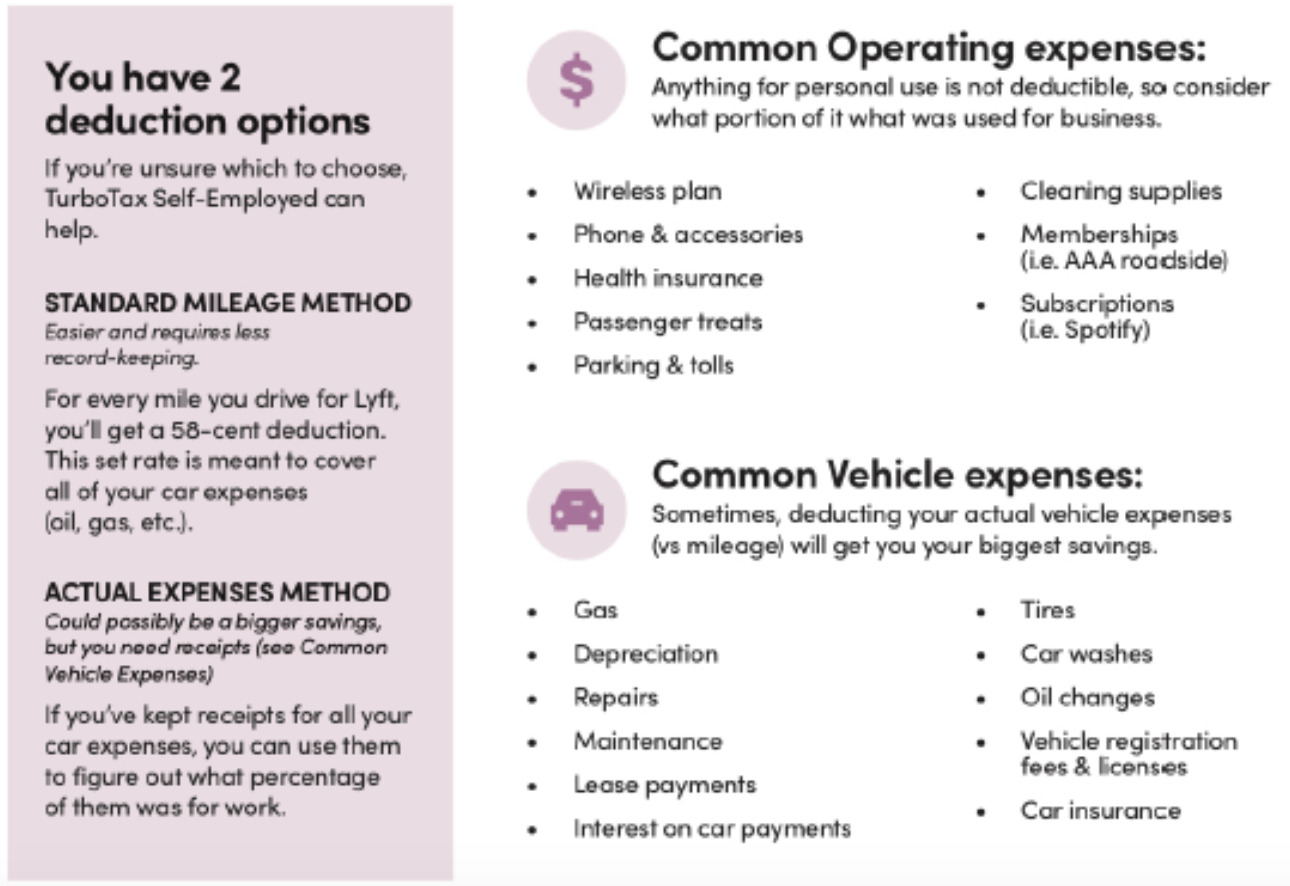

Tax preparation fees on the return. Those who are self-employed can still claim a tax deduction for the fees paid to prepare tax returns. Get Access to an Online Library of 85k Forms Packages that You Can Edit eSign Online.

Ad A Bit of Planning Now Can Keep You From Tax Filing Troubles Next Year. Our tax preparation fees for most individual tax returns is 500 to 700 and corporate tax preparation is generally 800 to 1000. However you may qualify for a deduction if you work as a contractor or you are self-employed.

Deducting Tax Preparation Fees on Personal Taxes. The information in the article below outlines the rules for the Tuition and Fees Deduction for tax years prior to 2021. December 2020 - IRS tax forms.

However the law is only valid from 2018 to 2025. A self-employed taxpayer can seek for tax preparation fees deduction on tax returns for the taxable year in which he pays it. The additional fee for Schedule D to report capital gains and losses was 118.

Self-employed workers pay the full. Congress will need to. Premium Federal Tax Software.

The cost of your. Find out more about. In many cases you cannot deduct your tax prep fees.

For example he can deduct tax preparation. The additional fee for Schedule E to report rental income and losses was 145. Examples of deductions a portion of which may be properly allocable to Gross Investment Income include investment interest expense investment advisory and brokerage.

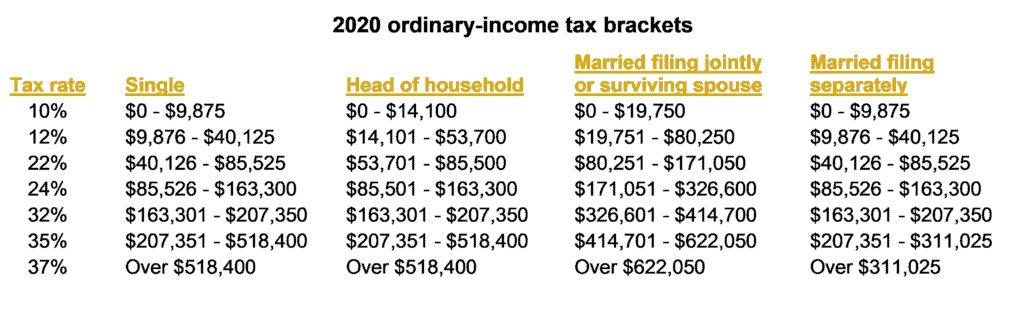

As a reminder the Social Security payroll tax is 124 percent with the employee paying 62 percent and the employer paying 62 percent. This means that if you. E-File Today Get Your Refund Fast.

Publication 529 - Introductory Material. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Selden NY. Publication 529 122020 Miscellaneous Deductions.

Although the tuition and fees tax deduction expired in 2020 taxpayers can still claim other deductions for qualifying education expenses subject to certain rules. Ad Sign Fill Out Legal Forms Online on Any Device. For example on your 2021 tax return you deduct the fees you paid to prepare your 2020 taxes.

All Extras are Included. Right now you can take the Tuition and Fees deduction for the 2020 tax. However the big question is how do you write off your tax preparation fees.

However the law is only valid from 2018 to 2025. Ad E-File Your Taxes for Free. The average fee dropped to 220 if you didn.

Tax Preparation Fees 2020 Deduction.

Solved Problem 5 33 Miscellaneous Deductions Lo 5 10 Chegg Com

Nearly 90 Percent Of Taxpayers Projected To Take Tcja Expanded Standard Deduction

Unexpected Tax Bills For Simple Trusts After Tax Reform

Tax Preparation Checklist Updated For 2021 2022 Blatner Mineo Cpa Pc

The Complete List Of Small Business Tax Deductions

Unexpected Tax Bills For Simple Trusts After Tax Reform

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Small Business Tax Preparation Checklist How To Prepare For Tax Season

Hsa Tax Deduction Rules H R Block

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Tax Season Warrants Preparation Among College Students News Dailytoreador Com

![]()

Start Up Cost Tax Deductions Pasquesi Partners

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter